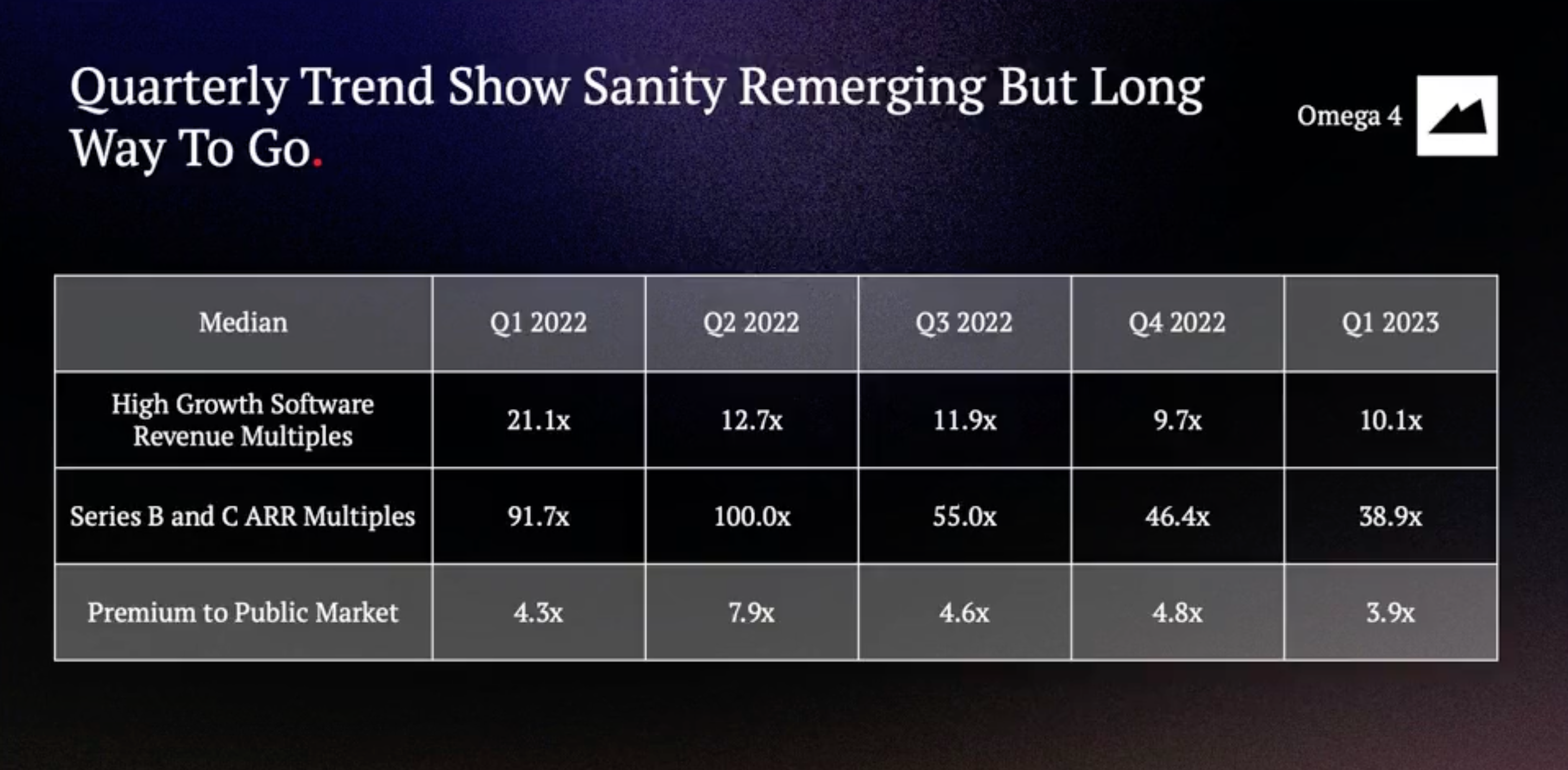

According to a recent presentation by Redpoint, ARR multiples for Series B and C companies dropped sharply from the all-time-high in 2022 (100x) to a more sober 39x, representing a 4x premium compared to public markets.

See also:

- In public markets, revenue multiples fell from 24x in 2021 to 10x in 2022

- Running a startup during a recession

- If there continue to be as few deals getting done, the backlog of startups that raised in 2021 and 2022 will run out of cash starting end of 2023

Links to this note

-

B2B SaaS businesses targeting enterprise customers that want to be in good shape to raise their Series B during a downturn need to have a run rate of $7-10MM ARR, growing at 2-5X year over year, gross margins 75-85%, and an LTV to CAC ratio of 3-5X. That’s because multiples fell from 100 to 39 times ARR and the target valuation multiples for Series B is ~20X ARR.

-

Time Between Series a and Series B Is 31 Months on Average

In 2023, the average time between raising a Series A and Series B round increased to 31 months according to Crunchbase. With startup funding falling 67% in 2022, more startups could face a difficult time getting funding. Some predict startups will run out of cash in 2023 with the most fiscally conservative ones run out in 2025 unless conditions change.

-

A collection of benchmarks for B2B businesses (mostly relevant for early-stage SaaS).